Trade War, Resignations, And Scandal Overshadow Rise In Leading Indicators

Stocks continued on a roller coaster ride, plummeting nearly 6% last week on fears of a trade war, as the economy continued to show remarkable strength that did not make headlines.

"The U.S. LEI accelerated further in January and continues to point to robust economic growth in the first half of 2018. While the recent stock market volatility will not be reflected in the U.S. LEI until next month, consumers' and business' outlook on the economy had been improving for several months and should not be greatly impacted," said Ataman Ozyildirim, Director of Business Cycles and Growth Research at The Conference Board. "The leading indicators reflect an economy with widespread strengths coming from financial conditions, manufacturing, residential construction, and labor markets."

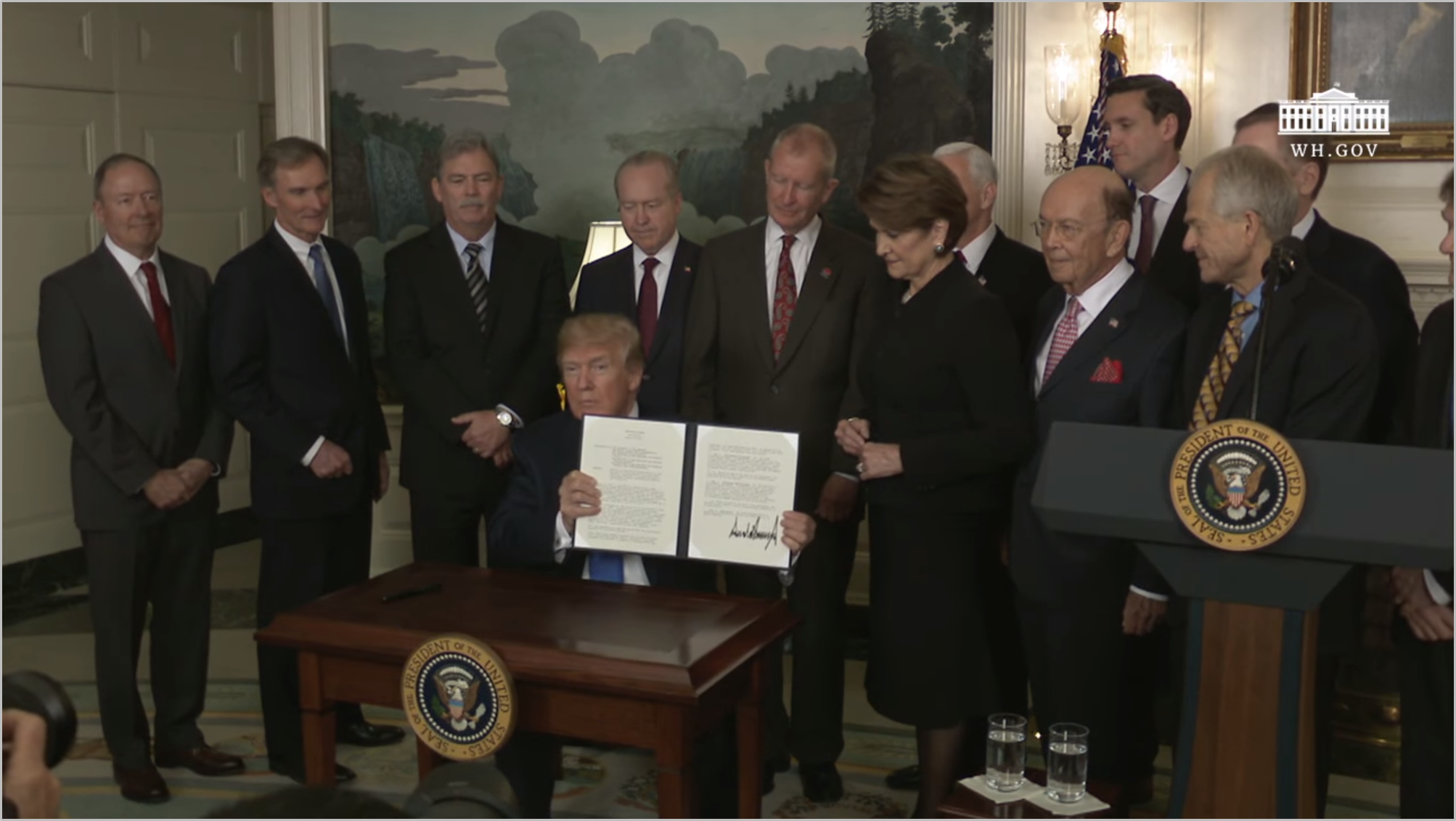

On Thursday, President Trump signed a Presidential Memorandum targeting China's "economic aggression" and branded China an economic enemy.

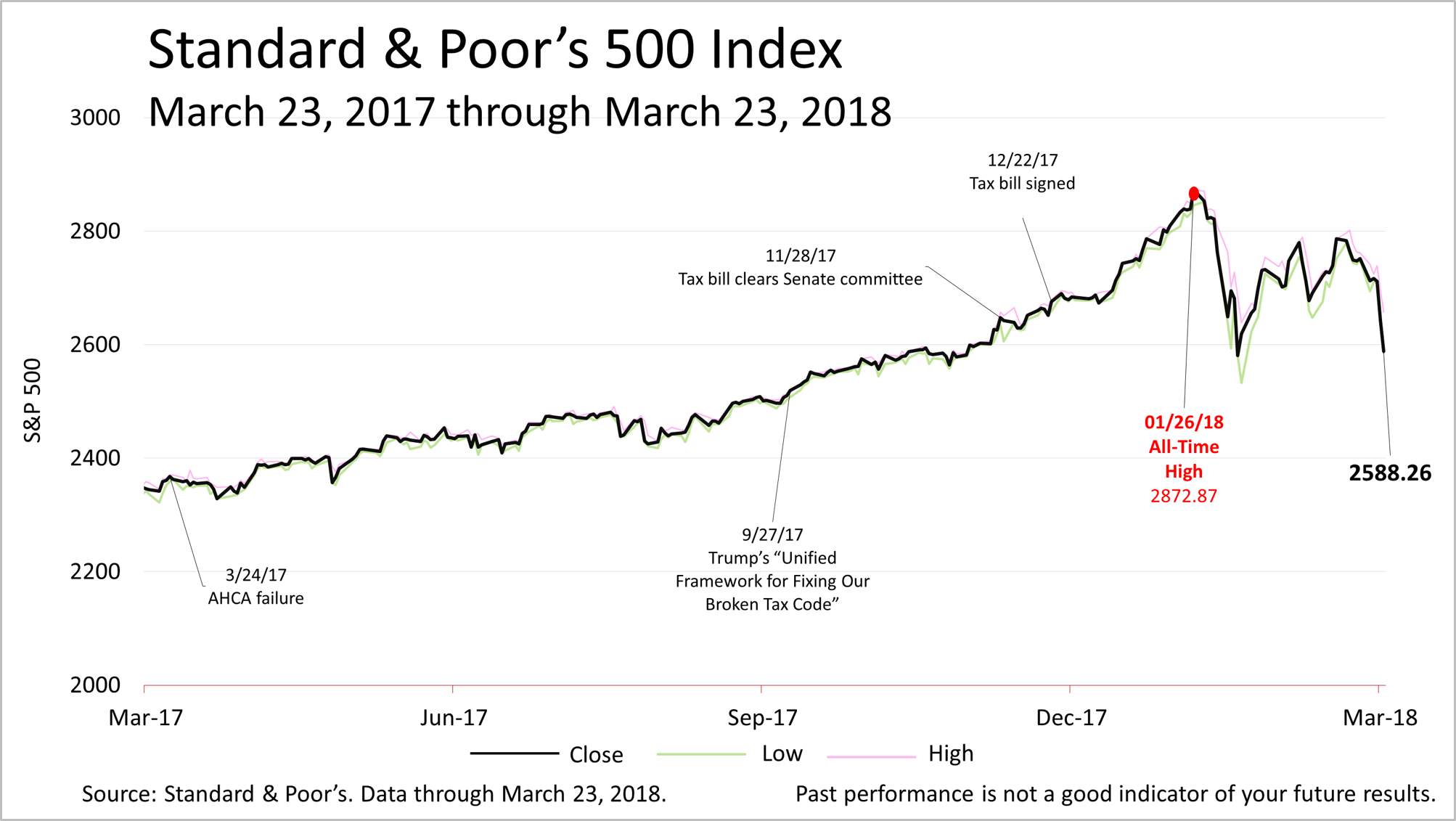

The Standard and Poor's 500 plunged about 5.4% for the week as fears of a trade war spread, the National Security Adviser was dismissed, and scandalous new accusations surfaced about Mr. Trump's personal life and competed for headlines.

Meanwhile, the U.S. Leading Economic Indicators were released on Thursday and strengthened again. In February, this key forward-looking barometer gained 0.6% following a 1% increase in January.

The U.S. LEI continues to point to robust economic growth in the first half of 2018, according to The Conference Board, a non-partisan group established more than a century ago. The Conference Board said the LEI reflected an economy with "widespread strengths coming from financial conditions, manufacturing, residential construction, and labor markets."

This forward-looking composite measures 10 indexes of economic activity that is higher than it has been in decades.

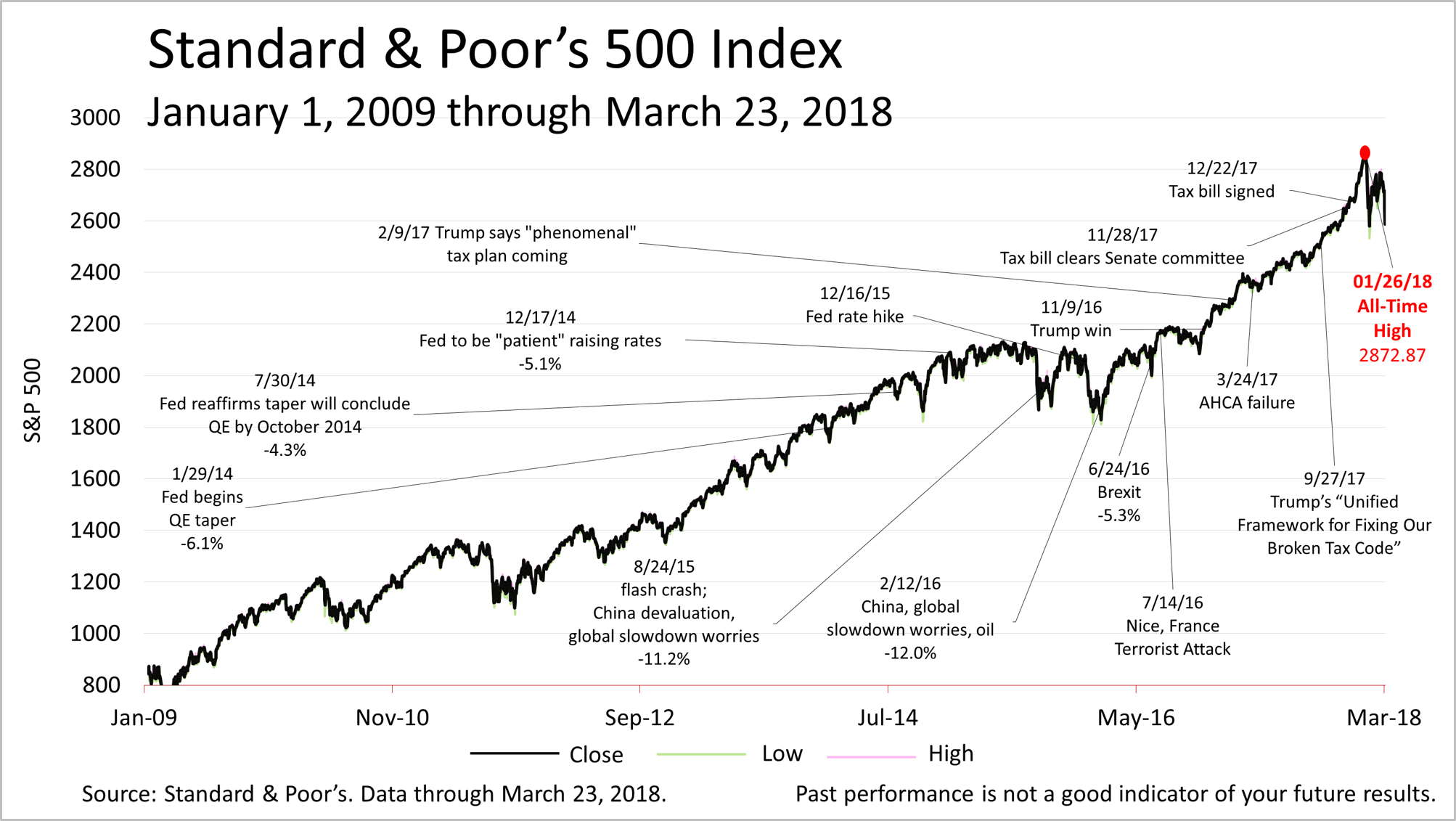

The bull market turned nine years old on March 9th, and this is the second-longest bull market in modern U.S. history.

Stocks are reasonably priced, and earnings expectations for 2018 are extremely strong compared with historical norms.

It's prudent to expect stock prices to be vulnerable to more plunges on frightening headlines, but economic fundamentals remain very strong, although that may have been lost in the sensational headlines and volatility.

This article was written by a veteran financial journalist based on data compiled and analyzed by independent economist, Fritz Meyer. While these are sources we believe to be reliable, the information is not intended to be used as financial advice without consulting a professional about your personal situation.

Indices are unmanaged and not available for direct investment. Investments with higher return potential carry greater risk for loss. Past performance is not an indicator of your future results.

© 2024 Advisor Products Inc. All Rights Reserved.

More articles

- Changes To Estate Tax Explained In This Week's Wealth Update

- 2018 Estate Tax Changes And What May Be Ahead

- Stocks Surge 1.7% Friday As Tariff Fears Subside And New Jobs Surge

- Understanding Economic Fundamentals

- A Guide To The New Rules On Tax Deductions In 2018

- The Economic News That Did Not Make Headlines This Week

- Will Rising Bond Yields Be Bad For Stocks?

- Investing For The Long Run Amid Volatility

- Stock Market Is Unfazed By Russia Indictment, Displaying What Makes America Great

- Stock Prices Corrected 11.8% Before Rallying Sharply Friday

- You Don't Need Perfect Knowledge To Invest Well

- Why Stocks Plunged Last Week

- What's Driving Stocks And How It Affects Portfolios

- Accelerating Earnings, Surging World Growth, And Stocks Break A Record Again

- How Portfolio Theory Worked In Real-World 2017