Stock Plunge Nears Bear Territory After Fed Hike

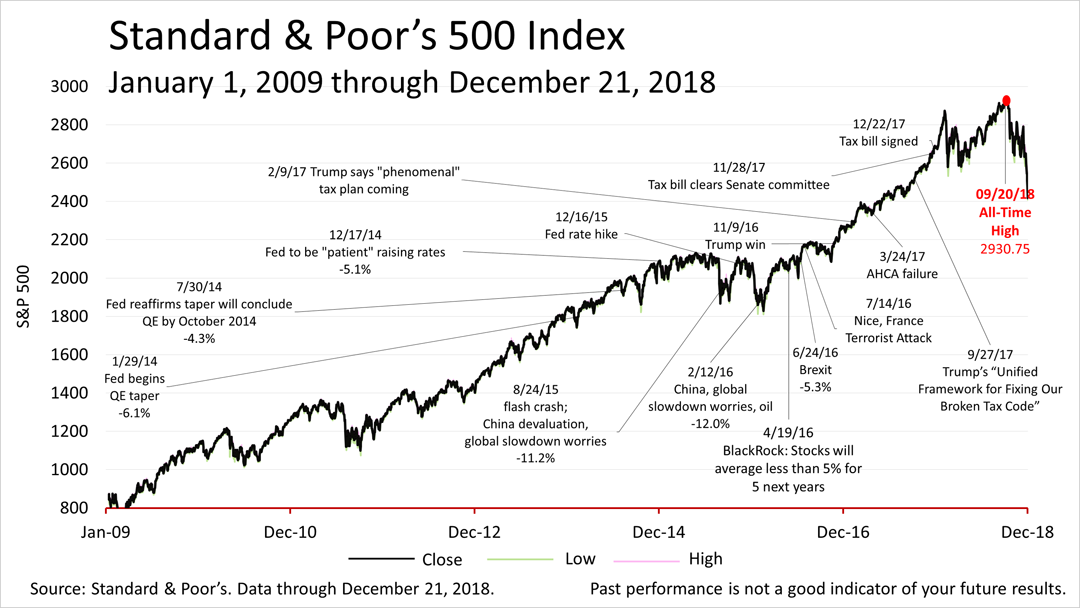

The Standard & Poor's 500 stock index closed Friday at 2416.62, teetering near bear market territory and threatening to end the 10-year bull market, the longest in U.S. history.

The S&P 500 hit an all-time closing high on September 20th, but has swiftly plunged by 17.8% since then, and its near bear market territory.

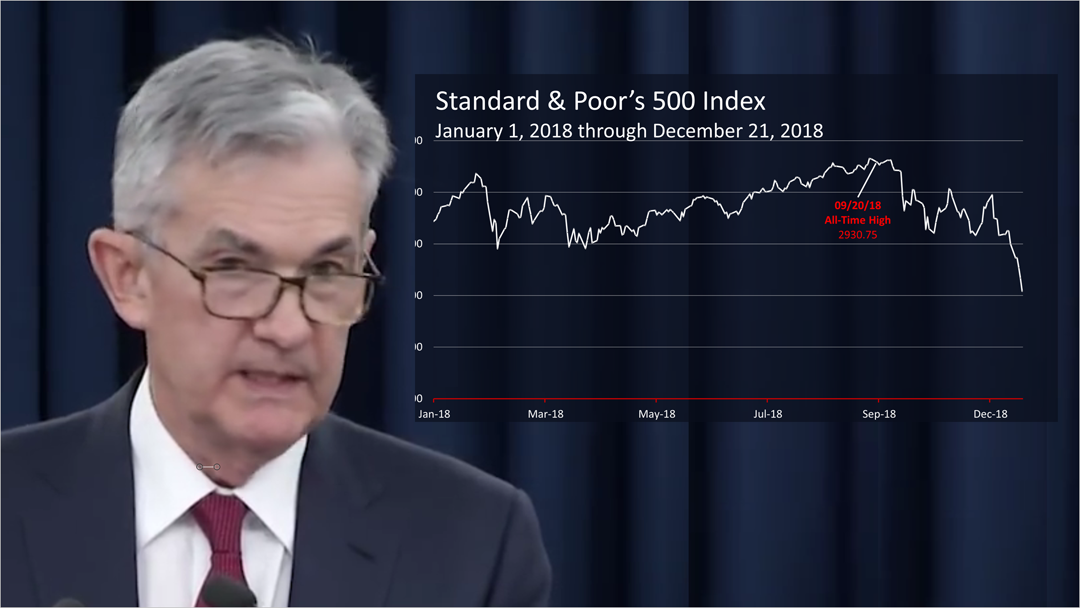

Friday's loss of 2% on top of Thursday's drubbing of 1.6% came in reaction to the Federal Reserve Board of Governors Chairman, Jerome Powell's, announcement on Thursday afternoon of a quarter-point hike in its key lending rate.

The Fed, months ago, announced its intention to hike lending rates four times in 2018, so the move was widely anticipated.

However, after the double-digit losses sustained in the past 12 weeks, it was unwelcomed by investors.

The Fed's job is not to please Wall Street, the President, or popular opinion. The Fed is just doing its job.

Since the recession ended in the third quarter of 2009 and when the current economic expansion began, the compound annual rate of growth of the U.S. economy was 2.2%, versus the 2.3% in growth expected over the next five years.

Even as the stock market teeters near bear market territory, the 2.5% GDP growth expected over the next five quarters by economists is strong.

This article was written by a veteran financial journalist. While these are sources we believe to be reliable, the information is not intended to be used as financial or tax advice without consulting a professional about your personal situation. Tax laws are subject to change. Indices are unmanaged and not available for direct investment. Investments with higher return potential carry greater risk for loss. Past performance is not an indicator of your future results.

© 2024 Advisor Products Inc. All Rights Reserved.

More articles

- HSA Or FSA: Which Is Better For Medical Savings?

- A Last-Minute Reminder To Give Wisely And Charitably

- Year-End 2018 Taxes And Your Home Office Deductions

- Key Facts About Tariffs, Interest Rates, And Economic Strength

- Strategic Considerations In Funding College

- Fed Chair Extends A Dovish Hand, Lifting Stocks

- S&P 500 Slid Last Week, As Earnings Growth Is Recalibrated

- Last Chance For Pre-Retired Professionals & Biz Owners

- A New Risk To Converting To A Roth IRA

- Amid A Swirl Of Controversy, Fed Policy Remained Stable

- A Reminder About Harvesting 2018 Tax Losses

- More Good Economic News On Friday

- Is Amazon Keeping The Inflation Rate Low?

- Analyzing The Market Correction

- This Week In Stocks And The Economy